Study

| EST. READ TIME 1 MIN.Aging population in Ontario leads to persistent deficits and increased health-care spending

The Implications of an Aging Population for Government Finances in Ontario

Summary

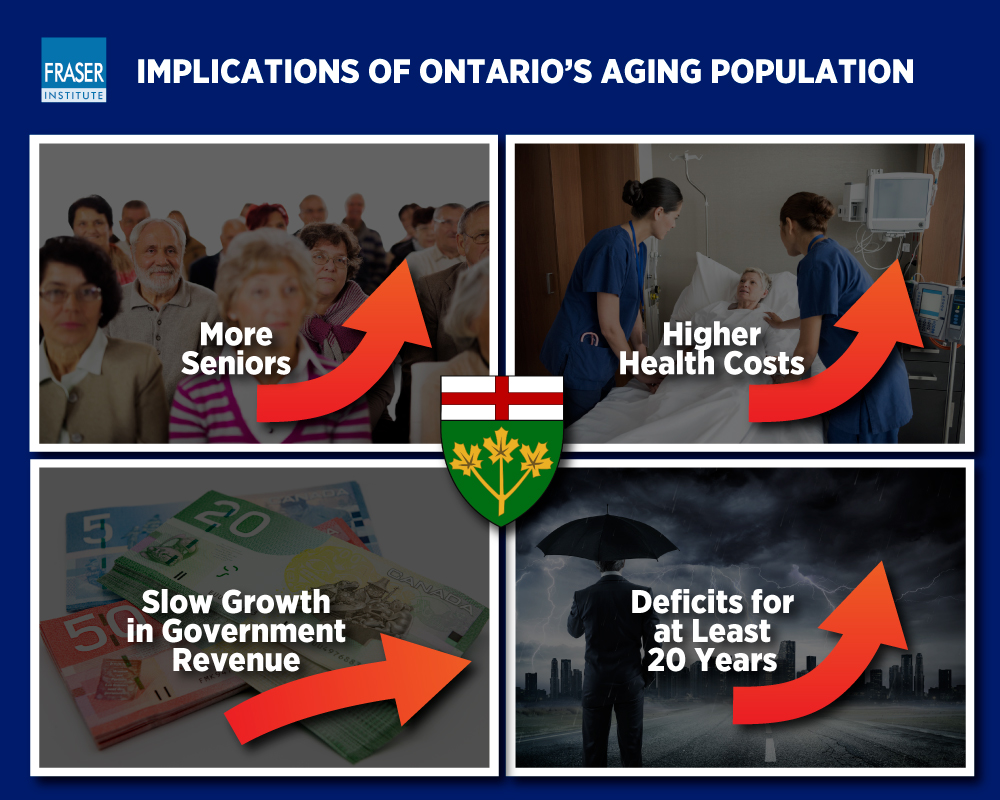

- Seniors currently compose 17.6 percent of Ontario’s population, and their share of the province’s population will continue to grow and reach nearly 24 percent by 2043.

- This will drive increases in health care spending and slow the growth in revenues, which will impose adverse effects on the provincial economy. The risk of future recessions, rising interest rates, and other unexpected events will only compound problems further.

- Health care expenditures are estimated to increase by approximately 4.1 percent annually from now until 2040/41. Put differently, Ontario’s health care spending will increase from 7.1 percent of GDP in 2019 to 7.6 percent in 2040.

- The aging population will exacerbate challenges for Ontario government finances and projections suggest that at the current trajectory the province will not see a balanced budget before 2040.

- Ontario is expected to run primary deficits (excluding interest costs) equivalent to between 0.3 and 0.4 percent of GDP, unless it makes changes to its spending or tax policies.

Share

-

Jake Fuss

Director, Fiscal Studies, Fraser Institute

Jake Fuss is Director of Fiscal Studies for the Fraser Institute. He holds a Bachelor of Commerce and a Master’s Degree inPublic Policy from the University of Calgary. Mr. Fuss has written commentaries appearing in major Canadian newspapers including the Globe and Mail, Toronto Sun, and National Post. His research covers a wide range of policy issues including government spending, debt, taxation, labour policy, and charitable giving.… Read more Read Less… -

Nathaniel Li

Senior Economist, Fraser InstituteNathaniel Li is a Senior Economist at the Fraser Institute. He holds a B.A. from the Fudan University in China anda Ph.D. in Food, Agricultural and Resource Economics from the University of Guelph. Prior to joining the Fraser Institute, he worked for the University of Toronto as a postdoctoral fellow and the University of Guelph as a research associate. His past research work has been published in many high-quality, peer-reviewed academic journals, including the Applied Economic Perspectives and Policy, Agricultural Economics, Preventive Medicine, and Canadian Public Policy. His current research covers a wide range of issues in fiscal, education, and labour-market policies.… Read more Read Less…

Related Topics

Related Articles

Ottawa’s GST break and rebate cheques amount to bad policy

By: Jake Fuss and Grady Munro

Onetime ‘tax rebates’—a bad idea for many reasons

By: Ben Eisen and Jake Fuss

Federal government crushing private-sector child care in Ontario

By: Matthew Lau