Study

| EST. READ TIME 2 MIN.Aging population and historically high spending pre-COVID mean no balanced budget for next 30 years

Canada’s Aging Population and Long-Term Projections for Federal Finances

Summary

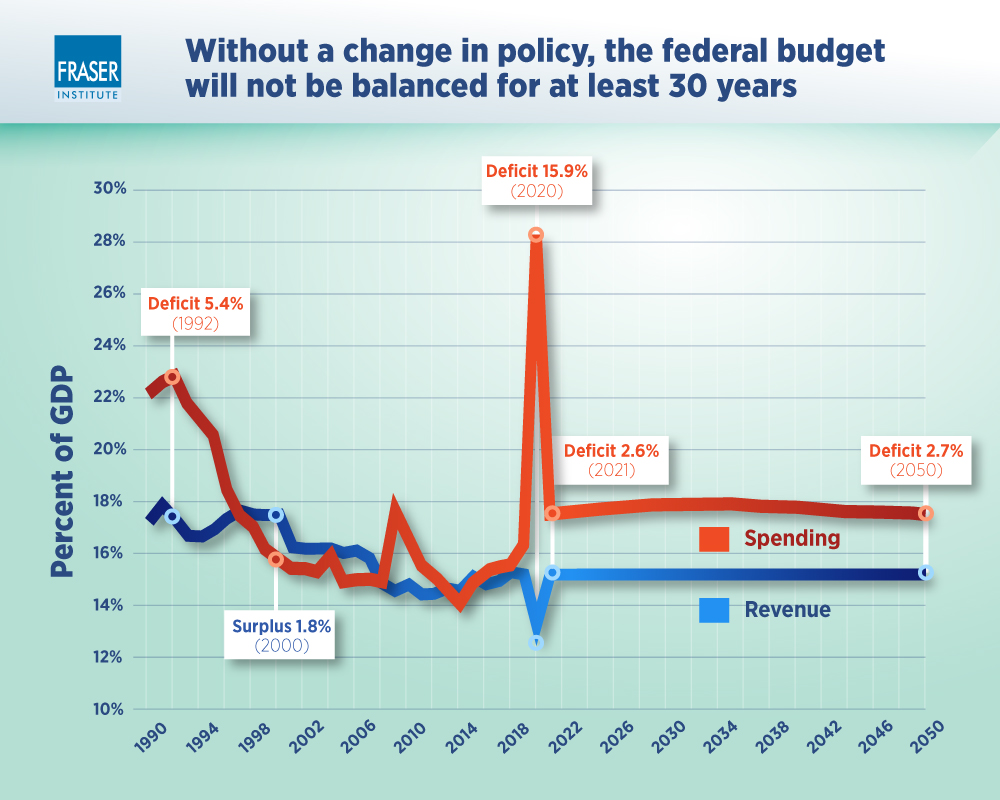

- Canada’s fiscal challenges extend far beyond just the short-term impact of COVID-19. An aging population will continue to place upward pressure on federal finances and a new structural imbalance between revenues and spending means deficits and debt are likely to continue growing for decades to come.

- A lower population growth rate coupled with increasing life expectancy means that the share of the population over 65 is projected to increase to 25.6 percent by 2068. This will require greater spending on income transfer programs to seniors like Old Age Security (OAS) and the Guaranteed Income Supplement (GIS).

- Declining population growth combined with an aging population also means that Canada will likely face a declining labour force participation rate, a slower growing labour force, and slower tax revenue growth.

- Spending on elderly transfer benefits is expected to peak at about 3.2 percent of GDP by 2031, an increase of almost 0.5 percentage points from the expected spending level in 2021.

- The long-term projections demonstrate that based on current trends, the federal government is not on track to balance its budget at any point during the next three decades.

- In our baseline scenario, the federal debt-to-GDP ratio might reach 69.6 percent by 2050, which would be the highest ratio recorded since 1948. If interest rates equal or surpass GDP growth, this ratio could exceed 100 percent of GDP between 2034 and 2039 depending on the extent of the difference between interest rates and GDP growth.

Share

-

Jake Fuss

Director, Fiscal Studies, Fraser Institute

Jake Fuss is Director of Fiscal Studies for the Fraser Institute. He holds a Bachelor of Commerce and a Master’s Degree inPublic Policy from the University of Calgary. Mr. Fuss has written commentaries appearing in major Canadian newspapers including the Globe and Mail, Toronto Sun, and National Post. His research covers a wide range of policy issues including government spending, debt, taxation, labour policy, and charitable giving.… Read more Read Less… -

Steven Globerman

Senior Fellow and Addington Chair in Measurement, Fraser InstituteMr. Steven Globerman is a Senior Fellow and Addington Chair in Measurement at the Fraser Institute. Previously, he held tenuredappointments at Simon Fraser University and York University and has been a visiting professor at the University of California, University of British Columbia, Stockholm School of Economics, Copenhagen School of Business, and the Helsinki School of Economics.He has published more than 200 articles and monographs and is the author of the book The Impacts of 9/11 on Canada-U.S. Trade as well as a textbook on international business management. In the early 1990s, he was responsible for coordinating Fraser Institute research on the North American Free Trade Agreement.In addition, Mr. Globerman has served as a researcher for two Canadian Royal Commissions on the economy as well as a research advisor to Investment Canada on the subject of foreign direct investment. He has also hosted management seminars for policymakers across North America and Asia.Mr. Globerman was a founding member of the Association for Cultural Economics and is currently a member of the American and Canadian Economics Associations, the Academy of International Business, and the Academy of Management.He earned his BA in economics from Brooklyn College, his MA from the University of California, Los Angeles, and his PhD from New York University.… Read more Read Less…

Related Topics

Related Articles

Ottawa’s GST break and rebate cheques amount to bad policy

By: Jake Fuss and Grady Munro

Onetime ‘tax rebates’—a bad idea for many reasons

By: Ben Eisen and Jake Fuss

Federal government crushing private-sector child care in Ontario

By: Matthew Lau