The Growing Debt Burden for Canadians: 2021 Edition

— Published on February 2, 2021

Summary

- Budget deficits and increasing debt have become serious fiscal challenges facing the federal and many provincial governments recently. Since 2007/08, combined federal and provincial net debt (inflation-adjusted) has doubled from $1.0 trillion to a projected $2.0 trillion in 2020/21.

- In 2020/21, combined federal and provincial net debt is expected to equal 91.6% of the Canadian economy, up from 65.2% last year.

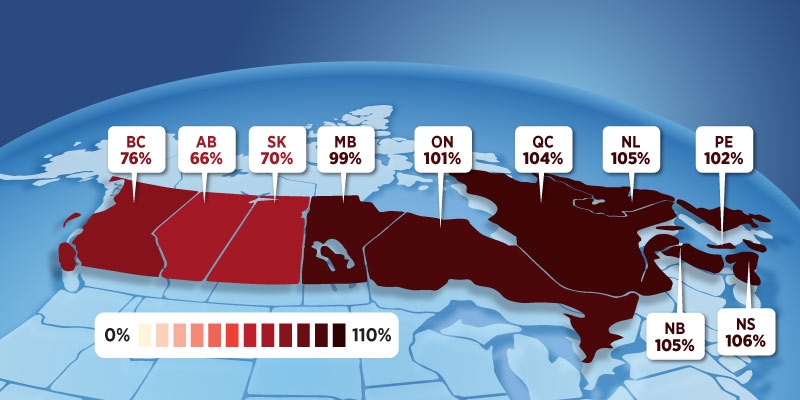

- Among the provinces, Nova Scotia has the highest combined federal-provincial debt-to-GDP ratio (106.0%), while Alberta has the lowest (66.1%). Newfoundland & Labrador has the highest combined debt per person ($64,224), closely followed by Ontario ($58,559). In contrast, British Columbia has the lowest debt per person in the country with $43,635.

- Interest payments are a major consequence of debt accumulation. Governments must make interest payments on their debt similar to households that must pay interest on borrowing related to mortgages, vehicles, or credit card spending. Revenues directed towards interest payments mean that in the future there will be less money available for tax cuts or government programs such as health care, education, and social services.

- Post-COVID, the federal and provincial governments must develop long-term plans to meaningfully address the growing debt problem in Canada.

Authors:

More from this study

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.