In the U.S., mattress industry lobbyists obtained a 744 per cent tariff on foreign mattresses.

tariff tax

You don’t make your country richer by imposing taxes on your consumers.

U.S. officials say WTO rules disproportionately advantage other countries.

Besides reducing their trade and investment linkages, foreign businesses may also reduce their reliance on the U.S. dollar.

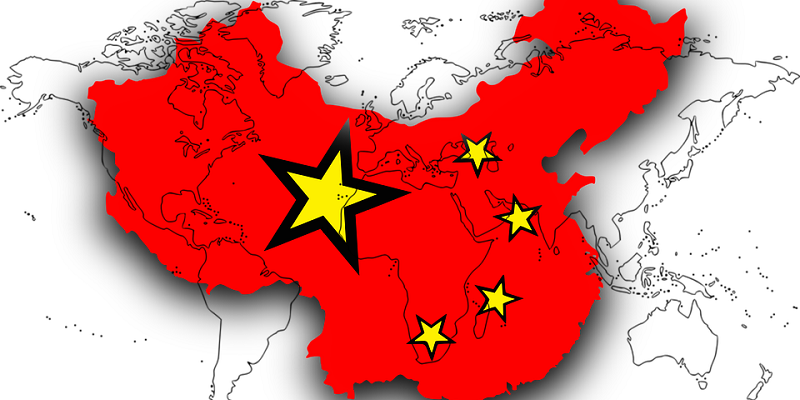

China’s economy tends to maximize its exports of high value-added products.

In 2018, China imported almost US$5.4 billion of crude oil from the U.S.

Whenever Canadians cross the border, it is inevitable they will find cheaper goods in the United States. Whether milk, books, electronic goods or vehicles, it seems bargains abound south of the 49th parallel.

The Canadian Senate has just done a bang-up job of adding hard data to anecdotal observations on this issue. In a recent report, the Standing Senate Committee on National Finance found several reasons for higher Canadian prices, including higher regulations in Canada and higher taxes. (The latter explains the difference in gasoline and diesel prices at the pump, for example.)