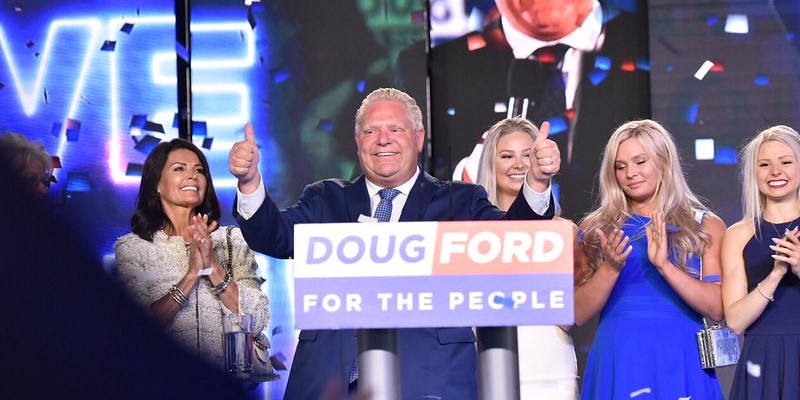

Ford government continues Wynne-like debt levels

A recent Fraser Institute study showed that the Ford government’s approach to government spending has been very similar to that pursued by the Wynne government in the mid-2010s. And that according to current government forecasts, spending will remain above Wynne-era levels for the next several years.

Given that the Ford government is following the same spending trajectory as in the recent past, it should come as no surprise that the province is also experiencing similar fiscal outcomes. In fact, the Ford government is racking up debt in much the same manner as its predecessor.

Let’s look at the numbers. In 2013, Premier Wynne’s first year in power, Ontario’s net debt (a measure that subtracts financial assets from total liabilities) increased by 16.2 billion. Over the course of its five years in charge of Ontario’s finances, the Wynne government added an average of $12.8 billion per year in new debt.

During this time, the Progressive Conservative party in opposition was harshly critical of the Wynne government’s pace of debt accumulation. Vic Fedeli, then-finance critic and the Ford government’s first finance minister, promised to take “immediate action to mitigate this fiscal mess.”

And yet, if the government’s most recent forecast proves accurate, between 2018 and 2024 the Ford government will increase debt by $20.7 billion annually on average. These outcomes can’t be blamed substantially on the pandemic and recession, as the pattern predates the pandemic and is forecasted to continue for years to come.

Of course, Ontario’s population has grown over the past decade and prices have increased, so it’s helpful to compare the two governments’ debt records making an adjustment for population growth and inflation. The table below shows that Ontario’s debt burden is on track to keep growing during the Ford years, just as it did under Premier Wynne. On average, adjusting for inflation, the Wynne government added $453 per person in new debt per year compared to $434 for the Ford government so far. This means that, after adjusting for price changes and a growing population, the two governments record on debt accumulation is almost identical.

As a result of this continued growth, the provincial government now carries more than $28,000 in debt for every Ontarian.

Clearly, the Ford government has failed to reduce Ontario’s debt burden relative to the size of the overall economy. This metric, known as the debt-to-GDP ratio, is a key way economists assess the scale of a jurisdiction’s debt burden. Both the Wynne and Ford government at various points made promises to bring this ratio down, but neither actually made any progress. As a result, this key indicator of fiscal health is projected to hover near its historical high for the remainder of the Ford government’s fiscal plan.

Despite rhetoric that the Ford government would address Ontario’s debt problem, these promises have not been kept.

Author:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.