Myth 1

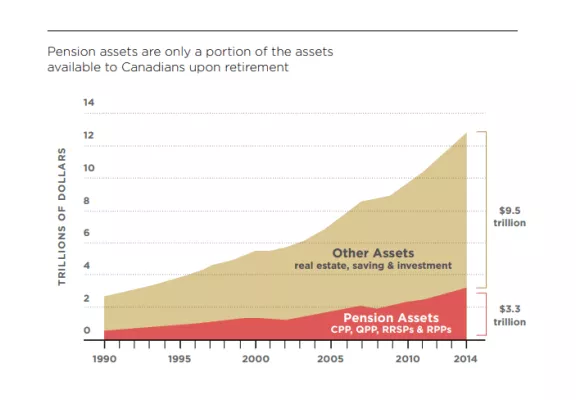

Canadians are not saving enough for retirement

The evidence shows most Canadians are well prepared for retirement and claims to the contrary ignore the ample resources outside the formal pension system available to Canadians when they retire.

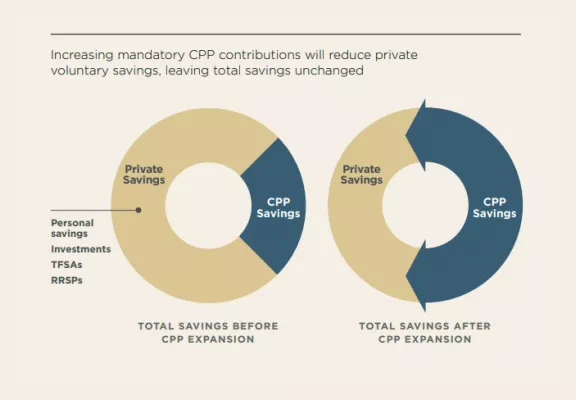

Myth 2

Higher CPP contributions will increase overall retirement savings

Forcing Canadians to contribute more to the CPP will reduce their private voluntary savings (in RRSPs, TSFAs, and other investments) resulting in little or no increase in total savings.

Myth 3

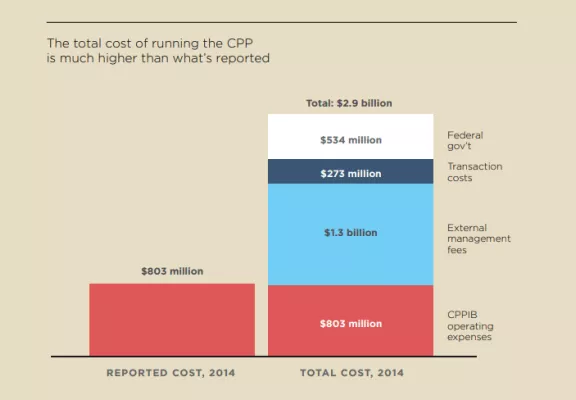

The CPP is a low-cost pension plan

The total investment and administration cost of running the CPP ($2.9 billion) is much higher than the operating expenses of the Canada Pension Plan Investment Board ($803 million), the entity that manages the CPP's investments.

Myth 4

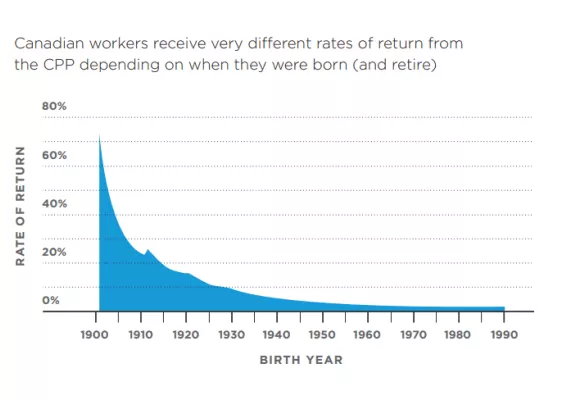

The CPP produces excellent returns for individual contributors

The CPP actually provides a meager rate of return (after inflation) of just 3% or less annually for Canadians born after 1956 and 2.1% for those born after 1971.

Myth 5

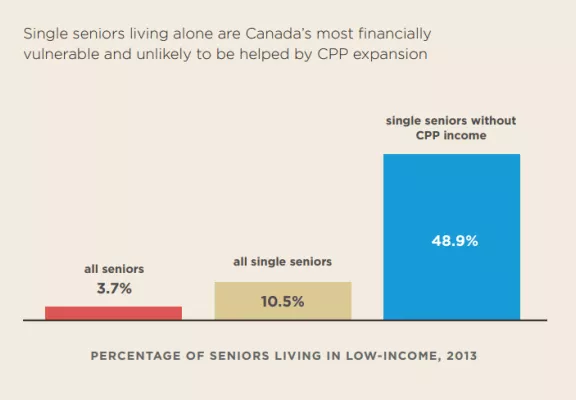

Expanding the CPP will help financially vulnerable seniors

Canada's most financially vulnerable seniors, including single seniors living alone with a limited work history, will gain little or nothing from an expanded CPP partly because many have not contributed to the CPP and therefore will not receive additional CPP retirement benefits.