Study

| EST. READ TIME 1 MIN.Per-person municipal government spending up 15.2 per cent on average in 17 municipalities across Metro Vancouver, 2009 to 2019

Comparing per-Person Spending and Revenue in Metro Vancouver, 2009–2019

Summary

- Municipal governments play an important role in the lives of British Columbians by providing key services and collecting taxes and fees.

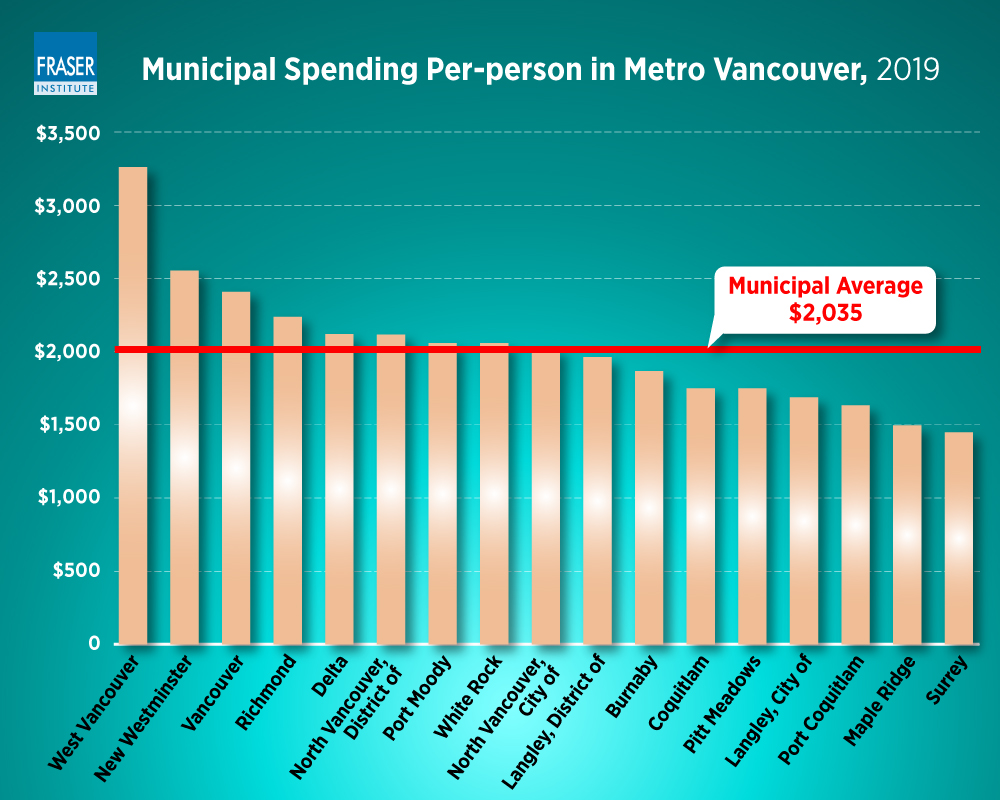

- There were very wide variations in per-person spending and revenue from 2009 to 2019 across the 17 municipalities of Metro Vancouver covered in this study.

- The average increase in per-person spending (inflation-adjusted) was 15.2%.

- West Vancouver was the highest spender in 2019 ($3,267 per person), while Surrey spent the least ($1,435 per person). New Westminster ($2,558) and Vancouver ($2,415) were the region’s next highest spenders.

- All 17 Metro Vancouver municipalities recorded increases in inflation-adjusted per-person spending over the eleven-year period.

- Double-digit growth occurred in 15 of the 17 municipalities. In four municipalities growth in per-person spending exceeded 20%: White Rock (27.7%), Richmond (24.0%), Port Moody (23.6%), and District of Langley (20.6%).

- The municipal average for growth in revenue per person was 22.7%.

- Coquitlam collected the most revenue (inflation-adjusted) per person ($3,181), followed by West Vancouver ($3,137) and White Rock ($3,133).

- Port Coquitlam collected the least ($1,813), followed by Surrey ($1,929), with the second lowest revenue per person in Metro Vancouver.

- Between 2009 and 2019, Coquitlam’s per-person revenue grew the most (58.7%), while only Port Coquitlam recorded a decrease (1.6%).

Share

-

Garreth Bloor

Senior Development Associate, Fraser InstituteGarreth Bloor is a Senior Development Associate with the Fraser Institute. His previous work in public policy includes roles asthe executive councillor responsible for economic development and spatial planning in the City of Cape Town, South Africa from 2012 to 2016. Mr. Bloor holds undergraduate degrees in social science and arts (Hons.) from the University of Cape Town and served on the university’s Council and University Research Committee. He has addressed events and presented papers at dozens of conferences globally. From 2018 to 2020 at the Canada-Africa Chamber of Business, he led trade and investment engagements in Canada and across the African continent.… Read more Read Less… -

Nathaniel Li

Senior Economist, Fraser InstituteNathaniel Li is a Senior Economist at the Fraser Institute. He holds a B.A. from the Fudan University in China anda Ph.D. in Food, Agricultural and Resource Economics from the University of Guelph. Prior to joining the Fraser Institute, he worked for the University of Toronto as a postdoctoral fellow and the University of Guelph as a research associate. His past research work has been published in many high-quality, peer-reviewed academic journals, including the Applied Economic Perspectives and Policy, Agricultural Economics, Preventive Medicine, and Canadian Public Policy. His current research covers a wide range of issues in fiscal, education, and labour-market policies.… Read more Read Less… -

Joel Emes

Senior Economist, Fraser InstituteJoel Emes is a Senior Economist, Addington Centre for Measurement, at the Fraser Institute. Joel started his career with theFraser Institute and rejoined after a stint as a senior analyst, acting executive director and then senior advisor to British Columbia’s provincial government. Joel initiated and led several flagship projects in the areas of tax freedom and government performance, spending, debt, and unfunded liabilities. He supports many projects at the Institute in areas such as investment, equalization, school performance and fiscal policy. Joel holds a B.A. and an M.A. in economics from Simon Fraser University.… Read more Read Less…

Related Topics

Related Articles

Federal government gets failing grade for fiscal transparency and accountability

By: Jake Fuss and Grady Munro

Ottawa’s GST break and rebate cheques amount to bad policy

By: Jake Fuss and Grady Munro