Study

| EST. READ TIME 1 MIN.Canadian generosity hits lowest point in 20 years

Generosity in Canada: The 2022 Generosity Index

- Manitoba had the highest percentage of tax filers that donated to charity among the provinces (20.6%) during the 2020 tax year while Newfoundland & Labrador had the lowest (16.0%).

- Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.73%) while Quebec donated the lowest (0.24%).

- Nationally, the percentage of Canadian tax filers donating to charity has fallen over the last decade from 23.4% in 2010 to 19.1% in 2020.

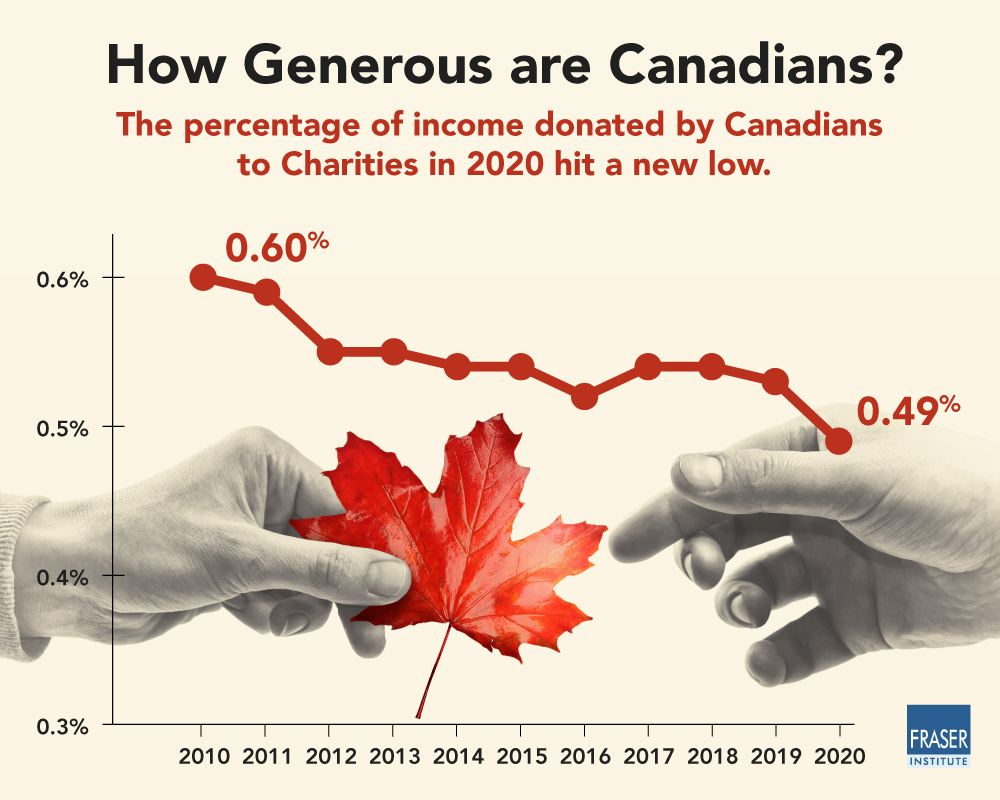

- The percentage of aggregate income donated to charity by Canadian tax filers has also decreased from 0.60% in 2010 to 0.49% in 2020.

- This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond.

Share

-

Jake Fuss

Director, Fiscal Studies, Fraser Institute

Jake Fuss is Director of Fiscal Studies for the Fraser Institute. He holds a Bachelor of Commerce and a Master’s Degree inPublic Policy from the University of Calgary. Mr. Fuss has written commentaries appearing in major Canadian newspapers including the Globe and Mail, Toronto Sun, and National Post. His research covers a wide range of policy issues including government spending, debt, taxation, labour policy, and charitable giving.… Read more Read Less… -

Nathaniel Li

Senior Economist, Fraser Institute

Nathaniel Li is a Senior Economist at the Fraser Institute. He holds a B.A. from the Fudan University in China anda Ph.D. in Food, Agricultural and Resource Economics from the University of Guelph. Prior to joining the Fraser Institute, he worked for the University of Toronto as a postdoctoral fellow and the University of Guelph as a research associate. His past research work has been published in many high-quality, peer-reviewed academic journals, including the Applied Economic Perspectives and Policy, Agricultural Economics, Preventive Medicine, and Canadian Public Policy. His current research covers a wide range of issues in fiscal, education, and labour-market policies.… Read more Read Less…

Related Topics

Related Articles

Understanding the necessity of economic growth

By: Philip Cross

Proposed HST cut not best option for tax relief in Nova Scotia

By: Alex Whalen