Study

| EST. READ TIME 2 MIN.Top 20% of Canadian income-earning families pay 53% of all taxes

Measuring Progressivity in Canada’s Tax System, 2022

Summary

- There is a common misperception in Canada that top income earners do not pay their share of taxes and that increasing taxes on this income group is an effective way to generate significant additional government revenue.

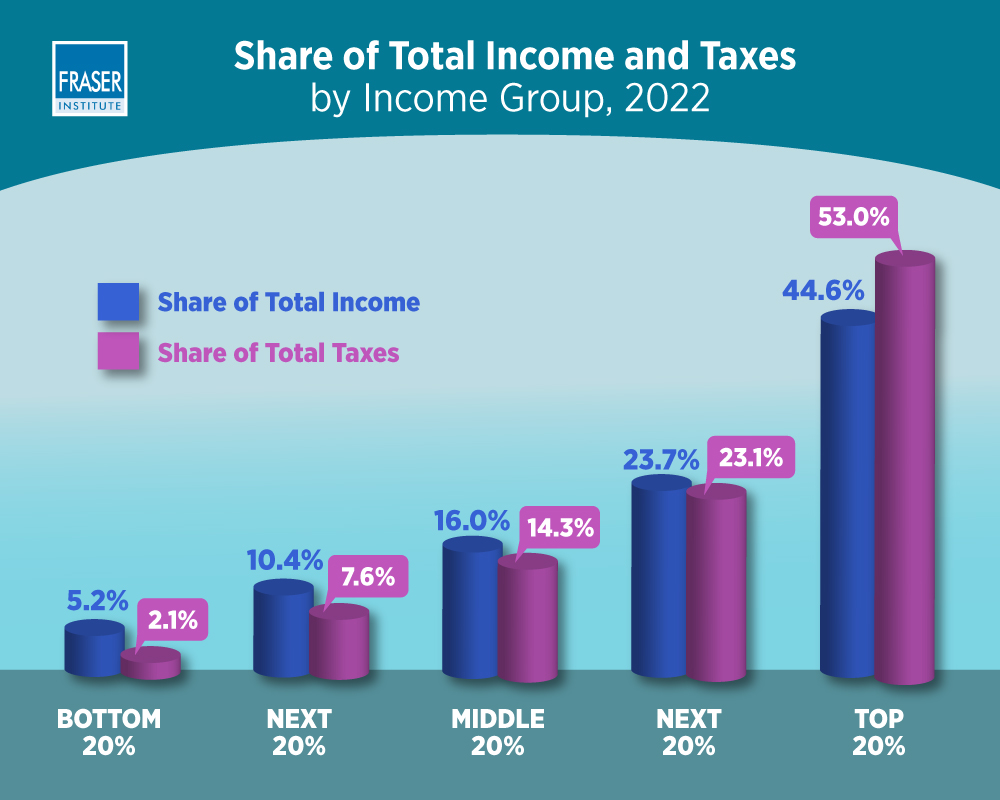

- However, high-income families already pay a disproportionately large share of all Canadian taxes. Indeed, the evidence shows that the top 20 percent of income-earning families pay nearly two-thirds (61.4 percent) of the country’s personal income taxes and more than half (53.0 percent) of total taxes.

- In contrast, the bottom 20 percent of income-earning families are estimated to pay only 0.8 percent of all federal and provincial personal income taxes and 2.1 percent of total taxes in Canada. This is, in part, due to the progressivity of Canada’s tax system, where the share of taxes paid typically increases as income rises.

- Raising taxes on high income earners ignores the economic consequences of tax rate increases and the associated behavioural responses of taxpayers when faced with higher tax rates or new taxes. In response to a tax increase, many taxpayers will change their behaviour in ways that reduce their taxable income through tax planning, avoidance, or evasion that results in governments raising less revenue than anticipated.

- Tax increases also reduce Canada’s competitiveness with other industrialized countries, particularly the United States. Specifically, increasing taxes on top income earners makes Canada a less attractive place to live and to work for highly skilled people such as doctors, scientists, managers, and software engineers.

Share

-

Jake Fuss

Director, Fiscal Studies, Fraser Institute

Jake Fuss is Director of Fiscal Studies for the Fraser Institute. He holds a Bachelor of Commerce and a Master’s Degree inPublic Policy from the University of Calgary. Mr. Fuss has written commentaries appearing in major Canadian newspapers including the Globe and Mail, Toronto Sun, and National Post. His research covers a wide range of policy issues including government spending, debt, taxation, labour policy, and charitable giving.… Read more Read Less… -

Nathaniel Li

Senior Economist, Fraser InstituteNathaniel Li is a Senior Economist at the Fraser Institute. He holds a B.A. from the Fudan University in China anda Ph.D. in Food, Agricultural and Resource Economics from the University of Guelph. Prior to joining the Fraser Institute, he worked for the University of Toronto as a postdoctoral fellow and the University of Guelph as a research associate. His past research work has been published in many high-quality, peer-reviewed academic journals, including the Applied Economic Perspectives and Policy, Agricultural Economics, Preventive Medicine, and Canadian Public Policy. His current research covers a wide range of issues in fiscal, education, and labour-market policies.… Read more Read Less…

Related Topics

Related Articles

Ottawa’s GST break and rebate cheques amount to bad policy

By: Jake Fuss and Grady Munro

Onetime ‘tax rebates’—a bad idea for many reasons

By: Ben Eisen and Jake Fuss

Tax reform would provide much-needed boost for Canada’s stagnant economy

By: Jake Fuss and Grady Munro

Trudeau’s new tax package gets almost everything wrong

By: Ben Eisen and Jake Fuss