Why Canada has an income tax—the ‘conscription of wealth’

“In such experience as I have had with taxation—and it has been considerable—there is only one tax that I know of that is popular, and that is the tax that is on the other fellow.”—Sir Thomas White, House of Commons debate on the income tax, August 3, 1917

Conventional wisdom has it that Canada’s income tax was introduced as a temporary measure. That’s not quite true. It did begin during a temporary emergency, the Great War, and it was officially named the War Tax Upon Incomes. But when at 3 p.m. on July 25, 1917, Sir Thomas White, Toronto journalist, tax assessor, and financier-turned-wartime-finance-minister, rose in the Commons to describe the new federal income tax he was proposing, he never used the word “temporary.”

Of the tax’s duration, the minister said only that “I have placed no time limit upon this taxation measure; but I do suggest… that after the war is over [it] should be deliberately reviewed… with the view of judging whether it is suitable to the conditions which then prevail.” This was in pointed contrast to the approach he had taken with the 1916 Business Profits War Tax, which initially he had limited to taxing war profits earned from 1914 through 1917. In the debate on the proposed new income tax, at least one MP confidently predicted, and celebrated, that it was here to stay. The opposition Liberals’ finance critic welcomed the tax, saying, “I have no doubt that the principle contained in the taxation proposals just submitted… will be approved of by the country.

In July 1917, Canada was almost three years into the bloodiest war ever. The Dominion’s contribution was heading toward 500,000 men in uniform, an astonishing number in a country whose entire population, male and female, was barely eight million. Yet through the winter and spring of 1917, Minister White continued to resist taxing personal incomes. He conceded an income tax might eventually be needed. But he repeatedly took care, even in the first few paragraphs of his speech introducing the new tax, to enumerate the arguments against it, including:

• Unlike the United Kingdom, which taxed incomes first during the Napoleonic Wars and then again from the government of Robert Peel in 1842, Canada was a large and spread-out country, without great concentration of wealth, so the tax would be hard to administer—although the Business Profits War Tax was run in Ottawa by a staff of 40, tiny by modern standards, which ultimately was kept on to help administer the income tax.

• The income tax was a direct tax, i.e., it had a person or firm’s name on it. But direct taxes were the only kind the British North America Act let provinces levy. Several provinces and some cities (including Ottawa and Toronto) already had income taxes, so a federal income tax would be the third such tax some Canadians would pay.

• Canada needed new immigrants as well as abundant foreign investment to fulfill the destiny proclaimed for it in the first years of the century by Prime Minister Sir Wilfrid Laurier (who in 1917, as Leader of the Opposition, was an active participant in the Commons debates on the income tax). Any income tax, White argued, let alone one with a high rate, would threaten Canada’s growth.

• And, finally, the graduated Business War Profits Tax was efficiently skimming off the rapid growth of business income generated by the booming wartime economy. (The new U.S. income tax, introduced in 1913, was small by comparison, White argued.) If the profits tax did miss some high incomes, well, wealthy Canadians were being very generous in buying the government’s Victory Bonds. An income tax might discourage such lending.

What changed Minister White’s mind? Conscription. In the summer of 1917, the Commons debated and approved compulsory military service, which until then had been avoided. Quebec separation aside, conscription was the most divisive issue Canadian politics ever contended with. In the election of December 1917, it badly split both the Liberal Party and the country.

Both morally and practically, however, conscription was key to the income tax.

Casualties had been appalling almost from the first day of war. Many in the Commons and the country felt that seizing people’s actual persons to serve a public purpose that might well involve their death or dismemberment was intolerably unfair unless property were also subject to seizure, especially from those not making physical sacrifices themselves. A phrase in the air that summer was “the conscription of wealth.” If young men were to be conscripted, wealth should be, too. The idea was so current that shortly before introducing his income tax, White felt obliged to state formally in the Commons that if he taxed anything new, he would tax income, not wealth.

Though he introduced it just a week after conscription was voted, White’s own stated motive for the new tax was mainly practical, not moral. The income tax would be needed, he said, to finance the up to 100,000 more soldiers, sailors, and airmen that conscription would deliver.

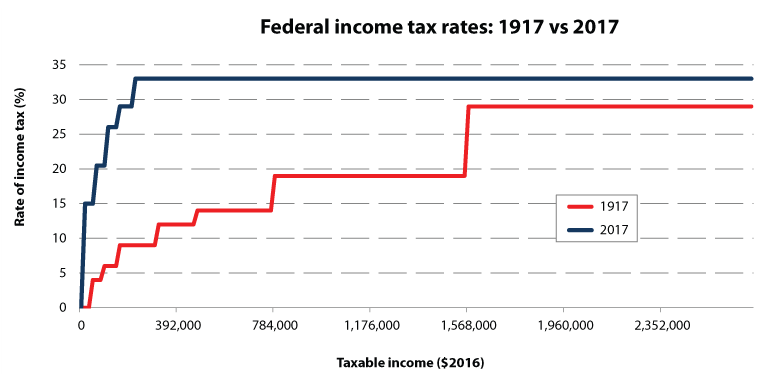

The tax White finally proposed was of a form barely recognizable today (see chart below). It featured a personal exemption for families on the first $3,000 of income and for unattached individuals on the first $2,000 (amended downward during debate to $1,500). Above that, everyone paid four per cent at the margin, with graduated surtaxes on top of that. The chart below compares the original 1917 rate structure with today’s, with all dollars expressed in $2016, each of which is worth roughly one-fifteenth of a 1917 dollar.

What stands out most starkly is that the 1917 surtaxes rise only very gradually and reach their maximum at an income of $1.6 million. There were no credits or exemptions for children or other dependents. (“It does not seem to me possible,” said White, “although it appeals to one’s sympathies, to make [such] a distinction.”) There was no capital gains taxation: it would be too complicated. (“In the administration of an income tax,” White argued, “you must get down to a sound, but rough-and-ready basis—a basis of good sense.”) Finally, there was no offset for provincial or municipal income taxes, although there was one for taxes already paid on dividends.

Should the income tax have been temporary?

The moral and practical emergencies both ended in November 1918. On the other hand, because of debt, in fiscal terms the war lingered for another two decades. Despite immediate and substantial hikes in virtually all existing taxes, as well as the eventual introduction of new taxes on profits and income, Ottawa’s debt quintupled in nominal terms during the war, from $335 million in March 1914 to $1.6 billion in March 1919, a number then regarded as verging on apocalyptic.

Although after the armistice there was no longer a need for armaments or soldiers, money had to be spent reintegrating those of the 500,000 who did return, many of them severely damaged by battle. The practical pressure did abate as, after a difficult initial recovery from war, the economy began to grow rapidly in the mid-1920s. But the moral pressure remained—people with higher incomes were better able to pay the continuing war finance. On top of that, there’s the democratic ratchet; that a change has been hard to make doesn’t mean it is easy to reverse.

Author:

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.