Canada’s Rising Personal Tax Rates and Falling Tax Competitiveness, 2024

— Published on April 9, 2024

- Between 2009 and 2023, federal and provincial governments have increased personal income taxes on upper-income earners by raising the top marginal income tax rate.

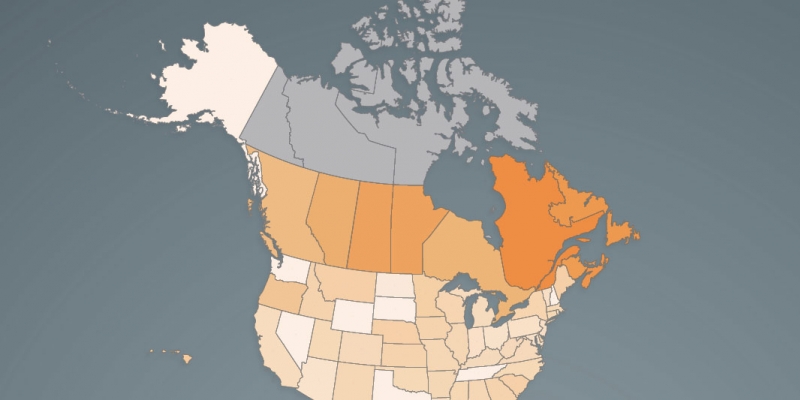

- The largest combined (federal and provincial) tax increase was in Newfoundland and Labrador, where the combined top marginal income tax rate increased 10.3 percentage points. This raised the province from one of the lowest combined top rates in Canada in 2009, up to the highest rate in the country in 2023.

- During this period, Ontario and Quebec’s combined top income tax rates increased by 7.1 percentage points and 5.1 percentage points, respectively.

- Empirical economic literature shows that high and increasing marginal taxes hinder economic growth and prosperity. Furthermore, these tax increases help put Canada at a competitive disadvantage for attracting and retaining skilled labour and, less directly, investment and entrepreneurs.

- Comparing the provinces with 51 US jurisdictions (includes all states and Washington DC) shows nine Canadian provinces occupying the list of the top 10 jurisdictions with the highest top combined marginal income tax rates, and all provinces are in the top 15.

- Canadian provinces are similarly uncompetitive with US jurisdictions when comparing personal income tax rates at the CA$300,000, CA$150,000, CA$75,000, and CA$50,000 income thresholds.

- Canada’s top combined statutory income tax rate is also uncompetitive compared to other industrialized countries. Out of 38 OECD countries, Canada’s top combined income tax rate ranks 5th highest.

Authors:

More from this study

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.