Prime Minister Trudeau's letter to Finance Minister Bill Morneau lists 27 priorities—we offer a quick reaction to 13 of these priorities.

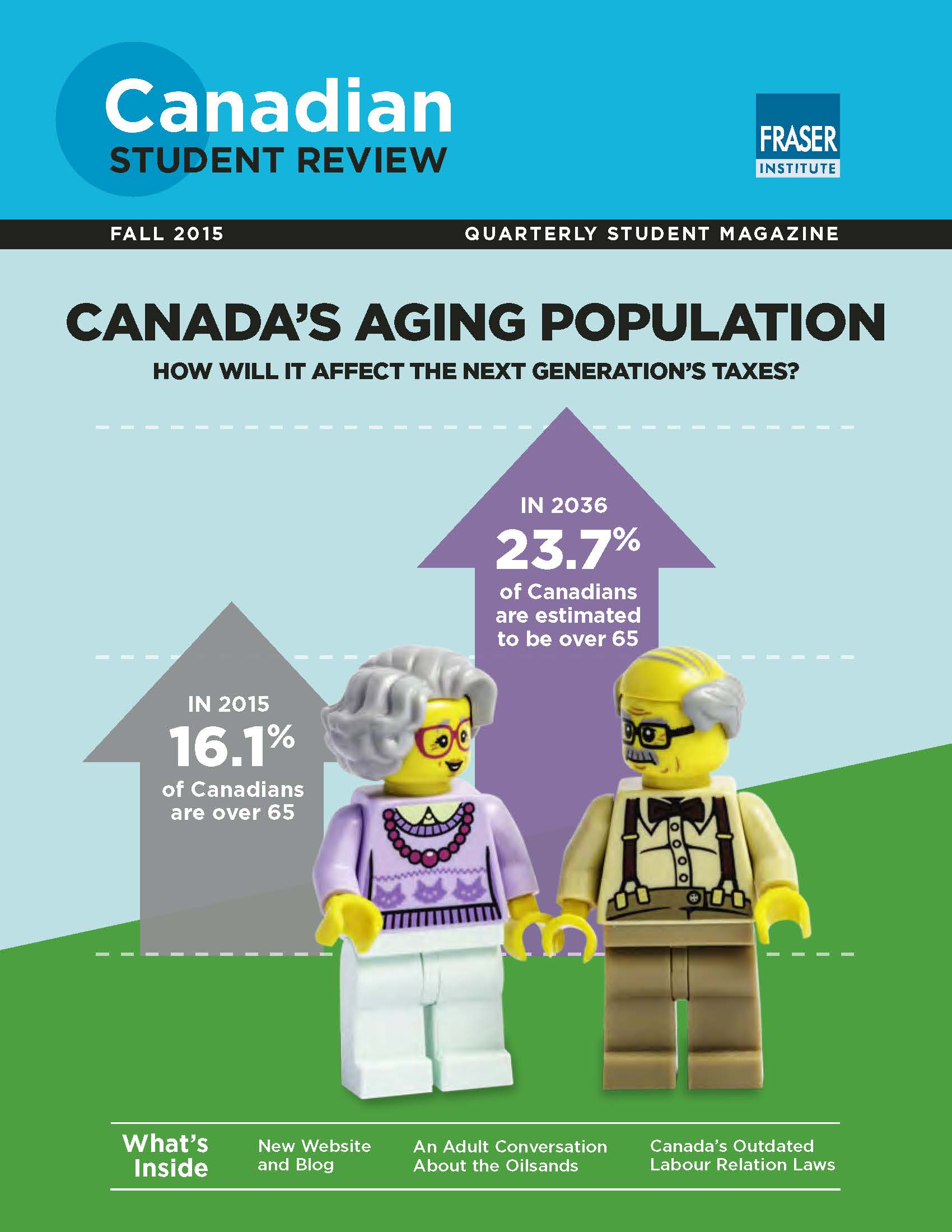

taxes

Raising tax rates increases revenues at lower tax rates—but as rates rise, a work disincentive effect kicks in, as well as a stronger tax-planning incentive that erodes revenues.

It’s true that in Montreal, our roads are chronically potholed and some of our highways, overpasses and bridges are literally crumbling. But does that come from any general reluctance to invest in public goods?

A reoccurring narrative in the income inequality debate is that top earners don’t pay their “fair share” of taxes. The data, however, paint a different picture.

These days, we economists tend to be very optimistic about the future, certainly compared to the ghastly visions of environmentalists and others.

Alberta’s economy is still on shaky ground as oil prices remain depressed relative to last year’s levels.

No one really thinks there shouldn’t be any taxes. After all, how would governments fund important public services that form the foundation of our economy? Think of services such as protecting property, building infrastructure, upholding the legal system, to name a few.

Provincial cries for more federal money are as old as Confederation, and rarely have any substance to them.