Nine-in-10 Canadian families with children will pay, on average, $2,218 more per year.

canadian personal income tax system

January 15, 2018

10:28AM

December 12, 2017

12:16PM

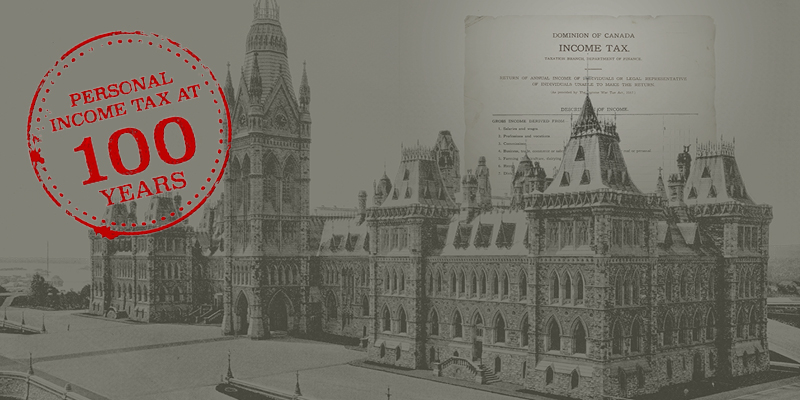

In 1917, the Income Tax Act contained 3,999 words—by 2016, it ballooned to 1,029,042 words.

September 15, 2017

10:20AM

The Liberal government raised the top federal income tax rate to 33 per cent from 29 per cent.

July 29, 2017

4:30AM

The current federal government raised the top federal personal income tax rate to 33 per cent.

April 27, 2017

9:31AM

As the tax deadline looms, here’s a brief history of Canada’s federal income tax, which has changed dramatically over the years.

April 10, 2017

12:23PM

In the early years, as few as one in 50 Canadians paid income tax.

April 6, 2017

10:38AM

The 1917 tax form, which was for both personal and corporate income, has just 23 just lines for the taxpayer.

April 6, 2017

1:00AM

October 6, 2016

2:07PM

Ontario’s top combined federal and provincial personal income tax rate is 53.5 per cent for skilled workers.

April 29, 2016

3:00AM

In the 12 years following 2001, there were almost two new tax expenditures per year.